Each credit card will be understood to have been used when any of the following transactions or services are performed: ATM cash withdrawal, retail purchases and transfers from the card credit limit to the associated account. They must also use this card at least once a month within each monthly card settlement period.

gas supply service for the mortgaged property(ies), and continue to pay for this service by direct debit through their Openbank account using the link provided by Openbank at all times. (vi) Each mortgage holder must take out or hold a credit card issued by Openbank in their own name, and this card must be linked to an Openbank account held by them. (v) The mortgage holder(s) must sign up for and maintain a Repsol S.A. (iv) The mortgage holder(s) must sign up for electricity supplies for the mortgaged property(ies) with Repsol, S.A and continue to pay for this service by direct debit through their Openbank account using the link provided by Openbank at all times. This life insurance policy must be current, arranged by direct deposit through an Openbank account held by the mortgage holders, and must insure 100% of the capital financed by one or between all of the holders. (iii) The mortgage holder(s) must be covered by the life insurance sold with their mortgage through Open Bank, S.A. If there are two or more holders, the minimum amount is €1,800 per month (ii) the property/properties subject to the mortgage must be insured with the Home Insurance marketed by Openbank, S.A., Linked Bancassurance Operator. For a single holder, the amount of any of the above items, both for a primary home and for a second home and/or self-employed, must be equal to or greater than €900 per month. Second home and/or self-employed: a salary, pension or any other type of periodic state benefit received by transfer must be set up with Openbank, or a deposit must be made from another bank into Openbank each month.

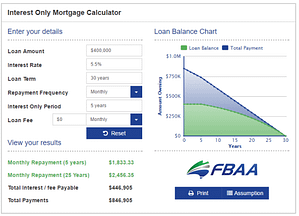

#Mortgage calculator interest full#

The amount charged for full prepayment will not exceed financial loss 3.ġ Interest rates subject to the following discount conditions: (i) Primary home: a salary, pension or any other type of periodic state benefit must be paid directly into Openbank. For fixed-rate mortgages, or fixed-rate tranches of any other mortgage:Ģ% of the remaining mortgage balance repaid early (full prepayment) during the first 10 years of the mortgage term or,ġ.5% when the full prepayment is made during the remainder of the mortgage term.

After that date, you must pay Openbank the percentage indicated here, if applicable, and in accordance with the terms and conditions of your mortgage loan deed. For variable-rate mortgages, or during variable-rate tranches of any other mortgage: 0.25% of the remaining mortgage balance repaid early (full prepayment) during the first three years of the mortgage term. However, this fee will not be charged if the early repayment (full) is made between the deed execution date and 31 December 2023. This reduction will be applied to the interest rate resulting from the amount, term and option you choose, regardless of whether discount conditions are met. If you finance more than €150,000, the applicable interest rate is reduced by 0.10% (in variable-rate and fixed-rate mortgage during the mortgage term).

0 kommentar(er)

0 kommentar(er)